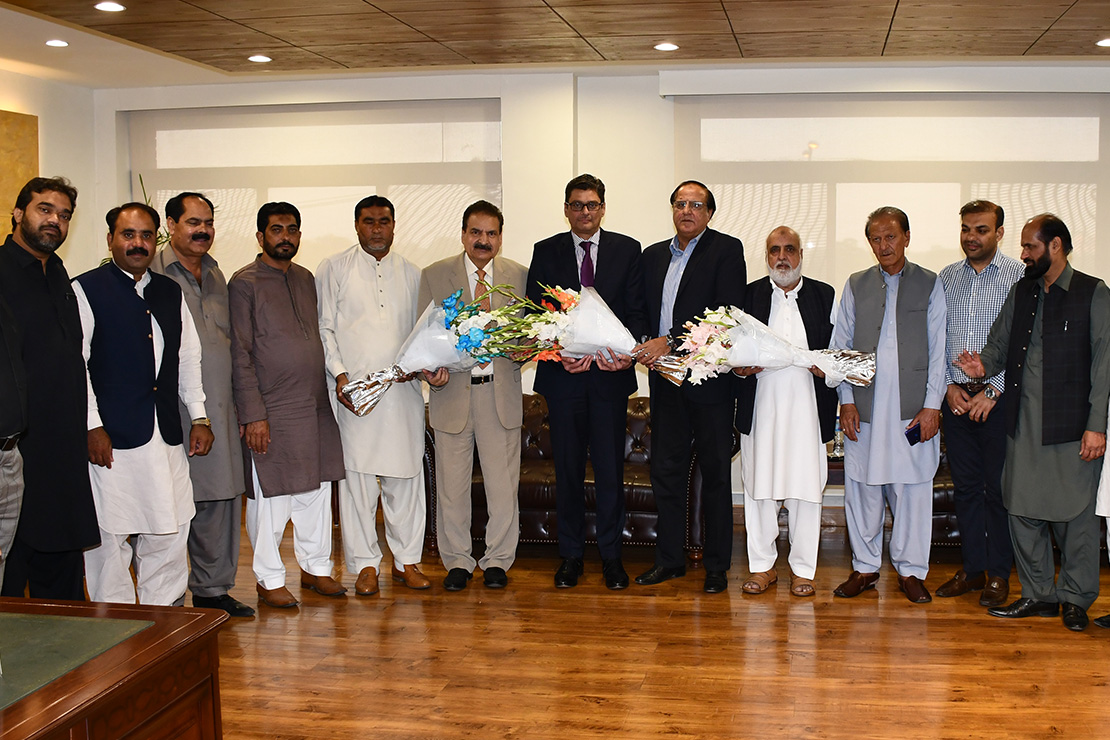

The business community in a meeting at Islamabad Chamber of Commerce and Industry (ICCI) slammed the FBR decision to restore the powers of tax officials for the attachment of bank accounts of taxpayers to recover the tax demands and termed it an anti-business decision that would create harassment in the business community and open new doors for corruption, coercion and malpractices. Mian Akram Farid Chairman Founder Group, Ahmed Khan President, Traders Association F-10 Markaz, Tahir Abbasi former Senior Vice President ICCI, Akbar Siddiqui Chughtai and others were in the meeting.

Addressing the meeting, Muhammad Shakeel Munir, President, Islamabad Chamber of Commerce and Industry said that to address the concerns of the business community regarding attachment of bank accounts, the former Chairman FBR Shabbar Zaidi had issued instructions to field formations not to attach bank accounts of taxpayers without 24 hours’ prior intimation and without approval of Chairman FBR, which had provided great relief to the business class. However, FBR through a new letter to Chief Commissioners Inland Revenue has withdrawn the previous instructions and restored the powers of tax officials under Sec-140 of Income Tax Ordinance Sec-48 of Sales Tax Act 1990 for recovery of outstanding demands through attachment of bank accounts, which has created lot of concerns in the business circles.

ICCI President said that the Prime Minister Imran Khan often assures the business community that his government is working to promote the ease of doing business, but FBR is taking decisions that would foil his efforts to create a conducive environment for the private sector. He said that such anti-business measures would shatter the confidence of taxpayers and increase gulf between them and the tax machinery. Therefore, he appealed to the Prime Minister and the Finance Minister to intervene and direct FBR for immediate withdrawal of new instructions as they would prove counterproductive and promote tax evasion in the country.

Mian Akram Farid Chairman Founder Group expressed disappointment over the restoration of powers of tax officials to attach bank accounts of taxpayers for recovery of tax dues and called upon the FBR to avoid taking such anti-business decisions as they would entail harmful consequences for business and economy.

Jamshaid Akhtar Sheikh Senior Vice President, Muhammad Faheem Khan Vice President ICCI and members of business community said that such unwise decisions would not help improve tax revenue, rather they would create more problems for the taxpayers and foil the efforts for broadening the tax base of the country. They strongly demanded that the FBR should immediately withdraw its new instructions to save the business community and the overall economy from further troubles.

Business community slams FBR decision for attachment of bank accounts of taxpayers

- October 13, 2021