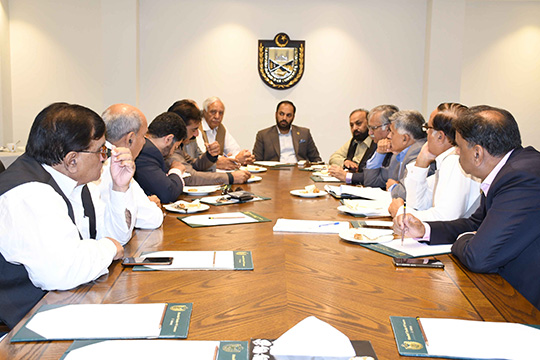

Aftab Ahmed, Advisor, Federal Tax Ombudsman, Islamabad said that FTO would play role to resolve tax complaints of business community for providing speedy and expeditious relief in tax grievances. He said this while addressing business community at Islamabad Chamber of Commerce & Industry. Nasir Mansoor Ahmed, Executive Member FTO also accompanied him at the occasion.

Aftab Ahmed said that FTO was working to provide justice in any malpractice or maladministration of FBR and stressed that business community should take full benefit of FTO services for redress of their genuine tax grievances. He said that he wanted to hold meetings with sector specific traders and industrialists to know about their tax grievances and take measures to address them. He desired that ICCI should cooperate with FTO in such pursuits. He said that tax consultants cost was quite high for business community and FTO was ready to organize training programs for business community on tax matters in collaboration with ICCI so that they could be facilitated in tax compliance. He said that on the feedback of business community, FTO could also give recommendations to government as well as to FBR for tax reforms. He said that FTO achieved 70 percent success in addressing maladministration cases and 50-60 percent success in refund cases which showed its useful role to address grievances of taxpayers.

Speaking at the occasion, Ahmed Hassan Moughal, President, Islamabad Chamber of Commerce & Industry said that FTO should establish its desk at ICCI to train its members on tax matters and help them in registering tax complaints that would help in speedy redress of tax grievances. He said that as per SBP report, FBR’s total tax collection was around Rs.1008 billion in 2007-08 that had increased to Rs.3842 billion by 2017-18 which showed that FBR’s tax revenue increased by over 281 percent during the last 10 years. However, he said that if FBR streamlined tax system and introduced low tax rates, it would further enhance its tax revenue.

ICCI President said that an efficient and effective FTO would help provide speedy relief to complainants, promote good governance, reduce tax complaints, improve FBR’s performance and enhance tax revenue. He said billions of rupees of taxpayers were stuck up with FBR in tax refunds and stressed that FTO should play role for release of such refunds that would reduce liquidity issues of taxpayers.

Iftikhar Anwar Sethi, Vice President ICCI, Zafar Bakhtawari, Naeem Siddiqui, Mian Muhammad Ramzan, Sheikh Muhammad Ilyas, Khalid Chaudhry, Tahir Abbasi, Mirza Muhammad Ali and others also spoke at the occasion and gave proposals for providing speedy and expeditious relief to aggrieved taxpayers.