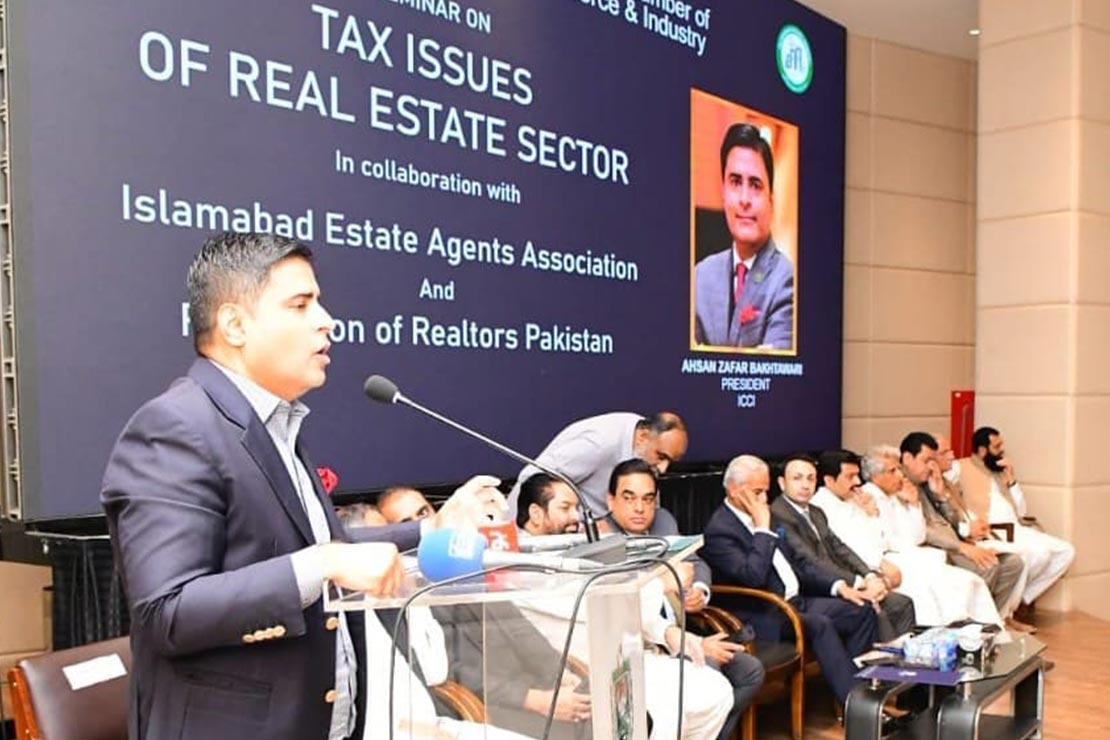

The construction and real estate sector is the backbone of the economy as it facilitates the growth of over 70 allied industries, generates economic activities, attracts investment and creates plenty of new jobs. However, the government in the budget 23-24 has imposed high taxes on the real estate sector that would destroy property businesses and ultimately retard the overall growth of the economy. Therefore, the government should urgently engage realtors in consultation and rationalize high taxes on this important sector to save the businesses and the economy from their destructive consequences. This was stressed by Ahsan Zafar Bakhtawari, President, Islamabad Chamber of Commerce and Industry (ICCI) while addressing a seminar on tax issues of real estate sector organized by ICCI in collaboration with Islamabad Estate Agents Association (IEAA) and Federal of Realtors Pakistan (FORP).

Ahsan Zafar Bakhtawari said that many businesses from real estate sectors have already closed down due to high tax rates and if these taxes were not revised, more businesses would face closure. He said that instead of imposing high taxes, the government should provide attractive incentives to the construction and real estate sector that would bring more investment to the country and help in early revival of the economy. He assured that ICCI would fully cooperate with IEAA and FORP in their efforts for resolving tax issues.

Speaking on the occasion, Sardar Tahir Mehmood, President, Islamabad Estate Agents Association and President, Federation of Pakistan Realtors highlighted the major tax issues of the real estate sector. He said that the 1% tax on deemed income of immovable assets under Sec-7E entails destructive consequences for the real estate and property sector and urged that the government should immediately withdraw this tax to save the real estate businesses from collapse. He said that the WHT on filer buyers and sellers has been raised from 2% to 3% while on non-filer buyers, it has been from 7% to 10.5% and on non-filer sellers from 4% to 6%. He said that these tax measures would have counterproductive impact as they would promote tax evasion instead of improving the tax revenue for the country. He cautioned that if the government did not revise high taxes on the real estate sector, the realtors would launch a strong protest against such coercive tax measures.

Faad Waheed Senior Vice President, Engr. Azhar ul Islam Zafar Vice President ICCI, Khalid Iqbal Malik Group Leader ICCI, Sardar Yasir Ilyas Khan former President ICCI & CEO Centaurus, Musarrat Ejaz Khan Chairman Federation of Realtors Pakistan, Abid Khan Chairman IEAA, Ch. Zahid Rafiq Secretary General IEAA, Ch. Masood & Ch. Abdul Rauf former Presidents IEAA, Malik Rahid Tufail, Rana Arshad and others also spoke on the occasion and called upon the government to withdraw high taxes on the real estate sector to save the economy from further troubles.

Realtors demand urgent withdrawal of high taxes on real estate sector

- July 22, 2023