President Islamabad Chamber of Commerce and Industry Ahsan Zafar Bakhtawari while presenting the budget proposals in the meeting of Senate Standing Committee on Finance said that the government needs to take steps to increase the tax net. The government should make all commercial meters subject to NTN numbers, which will significantly increase the tax net. There is a need to change the working hours to save energy. Suggestions from the business community across the country need to be seriously incorporated in the budget. In a difficult economic situation, the government should formulate an economic plan in consultation with the Chambers.

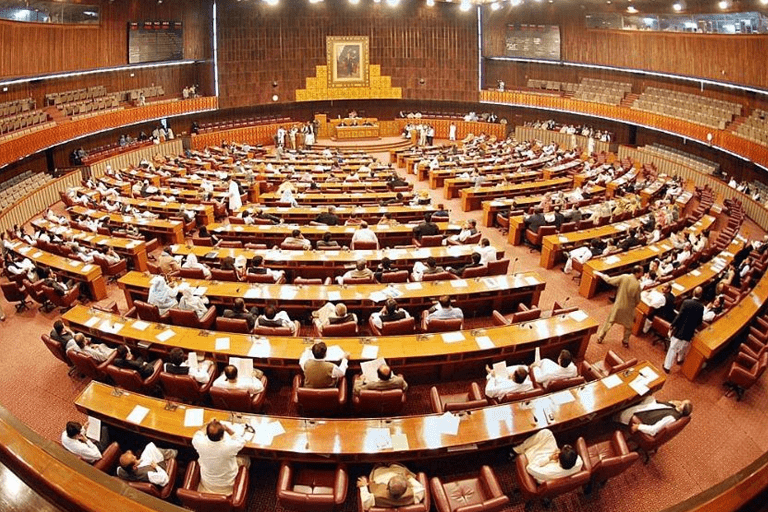

The meeting of the Senate Standing Committee on Finance was chaired by the Chairman Committee, Senator Saleem Mandviwala On Tuesday, In which the members of the committee Senator Sadia Abbasi, Senator Sherry Rehman, Senator Dilawar, Minister of State for Finance Ayesha Ghos Pasha, FBR officials, Presidents of Islamabad, Karachi, Lahore, Quetta, Faisalabad Chambers and Federation of Pakistan Chamber of Commerce, Pakistan Business Council participated.The meeting considered the recommendations of the business community for the preparation of the budget for the financial year 2023-24. President Islamabad Chamber Ahsan Bakhtawari while speaking in the meeting said that LCs and ban on imports, differences in commercial electricity tariffs at regional level, smuggling and all such problems are harming the country’s economy. There is a need to formulate policies on a permanent basis to solve them. POS integration should be mandatory for retailers as well as all distributors and manufacturers. The issue of filers and non-filers should be solved, supply should be given only those businesses that are POS integrated or have NTN numbers.

Chairman Taxation Committee Islamabad Chamber of Commerce Mian Ramzan said On the occasion that one million is a very small amount for advance tax and it should be increased.People hesitate to register new companies due to high taxes, dividend taxes should be exempted, tax on rental income should be reduced.On this occasion, Chairman Committee Senator Saleem Mandviwala while appreciating the budget proposals of Islamabad Chamber said that the best and workable proposals have come from the Chambers and the business community. We will place these proposals before the Finance Ministry and FBR try to make them part of the upcoming budget. He said that the business community has a very importent role in economic system of Pakistan. The Standing Committee will play active role in conveying their suggestions to the government.

President Islamabad Chamber of Commerce and Industry Ahsan Zafar Bakhtawari while presenting the budget proposals in the meeting of Senate Standing Committee

- May 23, 2023